Investment Options

21 Portfolios, one goal.

Indiana529 Advisor Savings Plan offers 21 different portfolios to meet the needs of every type of investor.

Investment Options

Indiana529 Advisor Portfolios

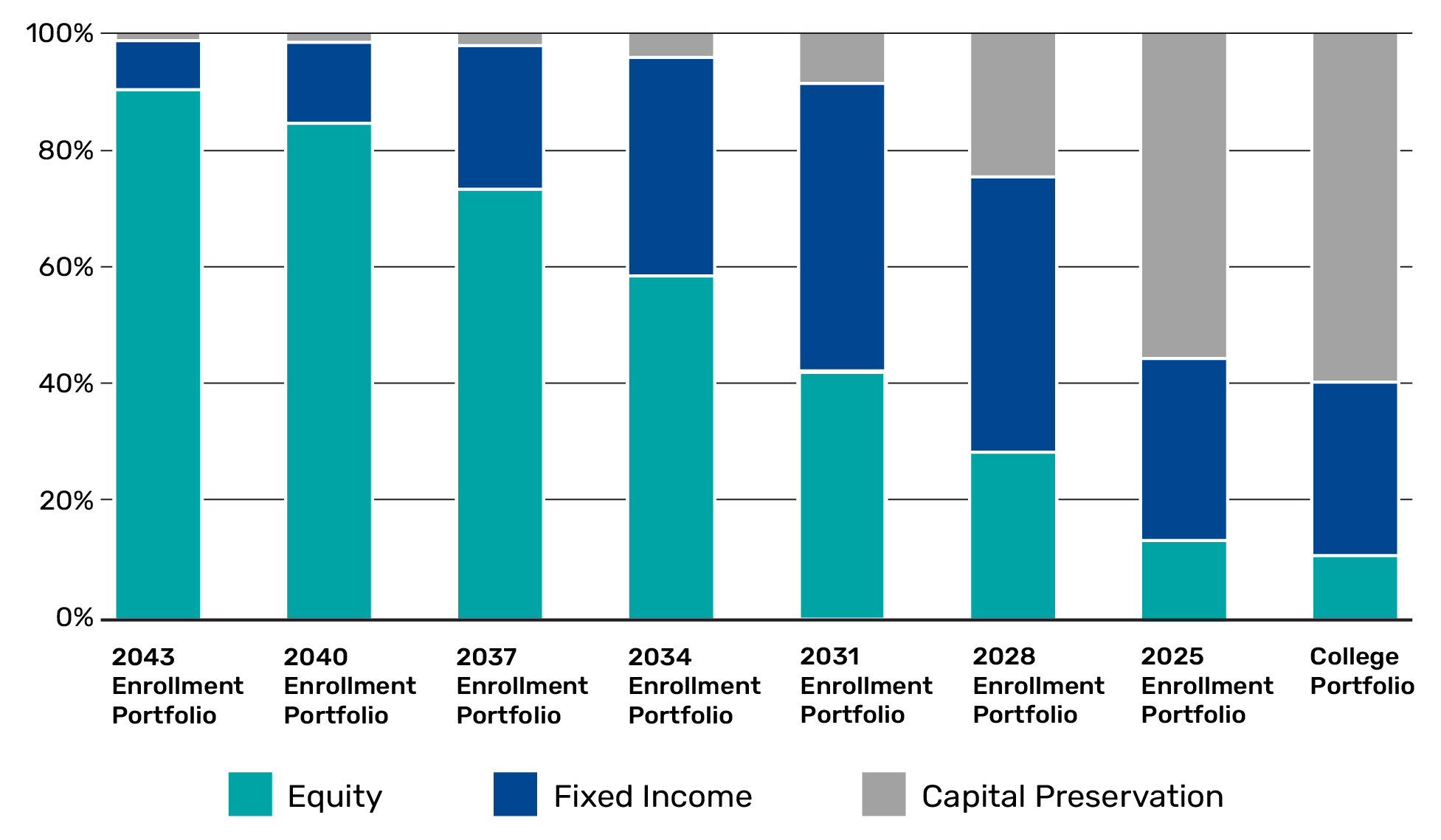

Three types of portfolios address a full range of risk tolerances and time horizons.

Portfolio Price and Performance

We are unable to display performance information at this time. Please refresh the page or check back later.

| Name | Unit value as of | YTD | Average annual total returns as of |

Inception date | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Unit value | Change | APY | 1 year | 3 year | 5 year | 10 year | Since inception** | ||||

| - (PUV) (PUV) (POP) (Without CDSC) (With CDSC) | |||||||||||

| Name | Average annual total returns as of |

Inception date | ||||

|---|---|---|---|---|---|---|

| 1 year | 3 year | 5 year | 10 year | Since inception** | ||

| - (PUV) (PUV) (POP) (Without CDSC) (With CDSC) | ||||||

1 The APY is net of program management and or state administrative fees. See the plan disclosure for more info.

** Since Inception returns for less than one year are not annualized. The performance data shown represents past performance. Past performance - especially short-term past performance - is not a guarantee of future results. Investment returns and principal value will fluctuate, so investors units, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited. For performance data current to the most recent quarter-end, click here.

Except for the Savings Portfolio, investments in Indiana529 Advisor Savings Plan are not insured by the FDIC.

Public offering price (POP) returns include the maximum initial sales charge of 5.25% (Portfolios greater than 50% equity exposure) and 3.75% (Portfolios greater than 50% fixed income exposure) for Class A units. Portfolio unit value (PUV) returns do not include sales charge or contingent deferred sales charge (CDSC). The CDSC returns for Class C units reflect the applicable contingent deferred sales charge of 1% through the first year.